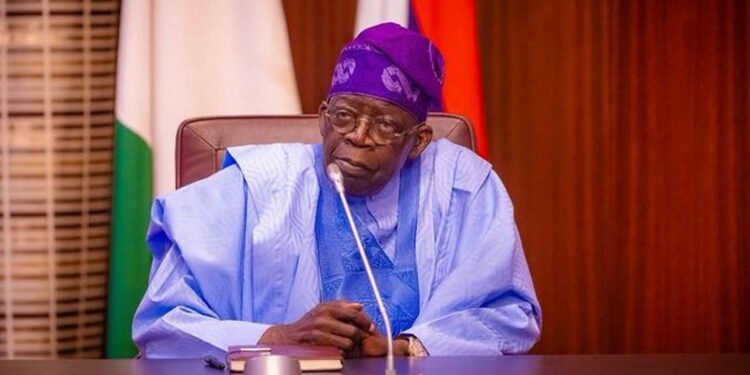

President Tinubu has set up a committee on tax reforms.

Newsone reports that Nigeria’s President, Bola Ahmed Tinubu has initiated a Presidential Committee on Fiscal Policy and Tax Reforms.

This online news platform understands that the setup of the committee was disclosed on Friday by Dele Alake, the Special Adviser to the President on Special Duties, Communications, and Strategy.

The committee will be led by Mr. Taiwo Oyedele, an esteemed expert in Fiscal Policy and Africa Tax Leadership at PriceWaterhouseCoopers (PwC).

Its composition will include professionals from both the private and public sectors, tasked with addressing various aspects of tax law reform, fiscal policy design, coordination, tax harmonization, and revenue administration.

Mr. Adelabu Zacch Adedeji, the Special Adviser to the President on Revenue, said President Tinubu recognises the significance of a robust fiscal policy environment and an efficient taxation system for the functioning of the government and the economy.

“Nigeria’s global ranking in ease of tax payment is dismally low, while the Tax to GDP ratio is among the world’s lowest and well below the African average,” Adedeji said.

“This has resulted in an overreliance on borrowing to fund public expenditure, subsequently limiting fiscal capacity as debt service costs progressively consume a larger portion of government revenue each year, perpetuating an unpropitious cycle of insufficient funding for socio-economic development.”

While acknowledging incremental progress made in recent years, Adedeji stressed that the outcomes have not been sufficiently transformative to alter the existing narrative.

He further outlined key challenges in Nigeria’s tax system, including multiple taxes and revenue collection agencies, a fragmented and intricate tax structure, low tax morale, prevalent tax evasion, high costs of revenue administration, lack of coordination between fiscal and economic policies, and inadequate accountability in tax revenue utilization.

Newsone Nigeria reports that the committee’s primary objective is to improve revenue collection efficiency, ensure transparent reporting, and facilitate effective utilization of tax and other revenues to enhance citizens’ tax morale, foster a positive tax culture, and drive voluntary compliance.

“Our aim is to revamp the tax system to support sustainable development and achieve a minimum Tax to GDP ratio of 18% within the next three years, without stifling investment or economic growth,” emphasised the Special Adviser on Revenue.

“It is important to note that this committee will not only provide advisory recommendations to the government but will also spearhead their implementation, in line with the comprehensive fiscal policy and tax reform agenda of the current administration.”